What is an SAS?

In an SAS (société par actions simplifiée), an entrepreneur can carry on any type of business. However, certain business sectors are excluded by regulation. For example, if you want to run a tobacconist's shop, you'll need to set up an SNC(société en nom commun). Regulated liberal professions are also excluded from the SAS.

A definition of the SAS legal form

The SAS is a legal entity. It is considered a commercial company. This legal form is governed by the Civil Code and the Commercial Code. Its shares may not be distributed to the public, nor may they be traded on a regulated market.

The SAS is appreciated by entrepreneurs for its flexibility. The partners have a great deal of latitude in drafting the articles of association. These define the decision-making procedures within the SAS, as well as the framework for the transfer of shares: approval clause, non-transferability clause, etc.

Before opting for this legal form, it's a good idea to find out all about the advantages and disadvantages of the SAS, to make sure it meets the needs and specifics of your project.

SAS share capital

The minimum share capital for an SAS is one euro. It is freely determined by the partners. In a société par actions simplifiée (simplified joint-stock company), the share capital can be constituted in different ways:

- Cash contributions: cash.

- In-kind contributions: equipment, vehicles, buildings, goodwill, patents, etc.

- Industrial contributions: know-how, etc.

For contributions in kind in a SAS, a contribution auditor is required. This requirement may be waived under two conditions:

- one of the contributions in kind is not worth more than 30,000 euros;

- the total value of contributions in kind must not represent more than half the share capital of the SAS.

At the time of formation, at least half of the share capital must be paid up. This amount is paid into the SAS current account. The other half must be paid up within five years of registration of the SAS.

How does an SAS work?

An SAS must have a Chairman. He represents the company in dealings with third parties. He has civil and criminal liability. In the event of mismanagement, the Chairman may be held liable. The Articles of Association specify all the powers vested in the Chairman of an SAS. The partners may decide to grant him the following two powers:

- SAS administration;

- SAS management.

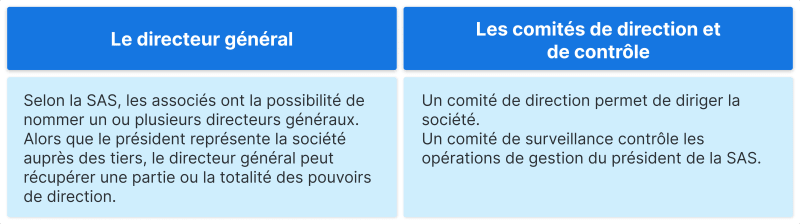

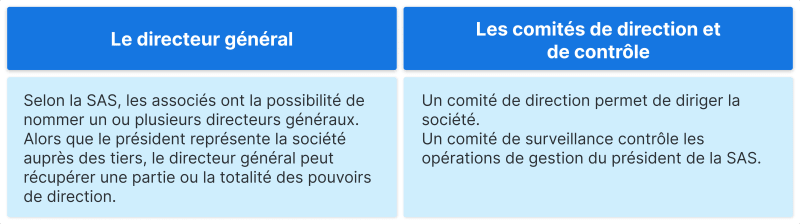

The Articles of Association of a SAS set out the management bodies that may be deployed within the company:

The partners of an SAS are free to choose the management method they wish to use, by specifying it in the articles of association. It's a good idea to enlist the help of experts to help you get your company off the ground.

What's the difference between a chairman and a managing director?

The chairman of an SAS has full powers of internal management and representation. A société par actions simplifiée (simplified joint-stock company) may have a chairman accompanied by a managing director. The latter may be delegated some of the Chairman's powers.

This structuring allows for a more flexible distribution of management responsibilities. The Managing Director may be assigned specific tasks, such as day-to-day management of the company. The Chairman then concentrates on long-term strategies and external relations. Opting for this type of configuration implies a better distribution of workloads. Entrepreneurs thus strengthen the company's ability to respond effectively to operational and strategic challenges.

How are decisions made in a SARL?

Through the articles of association, the partners determine the decision-making procedures. There are a number of possible provisions: consultation in writing or at a meeting, quorum rules, majority rules, etc. Certain decisions, such as the transfer of the registered office, can be taken autonomously by the SAS manager. On the other hand, other decisions must be approved by the shareholders: modification of the SAS corporate purpose, modification of share capital, increase in SAS share capital, etc.

Collective decision-making in SAS requires at least a majority of the votes cast, i.e. half plus one. It is not legal to depart from this rule in the SAS Articles of Association. On the other hand, in a SASU (société par actions simplifiée unipersonnelle), the sole shareholder is the sole decision-maker.

The SAS tax system

The SAS tax system deserves a detailed presentation. By default, corporate income tax applies. However, income tax remains an option.

Corporate income tax: the basic tax regime for SAS

SAS companies are automatically subject tocorporate income tax (IS). Each year, it must file a declaration of income (déclaration de résultat n°2065). The tax return must be filed within three months of the end of the financial year. The amount of corporate income tax due is determined on the basis of the SAS's results for its last financial year.

Income tax: a possible option

The SAS may opt to payincome tax (impôt sur le revenu - IR), provided it meets the following conditions:

- Main activity: unregulated self-employment, crafts, trade or farming.

- Have been in existence for less than five years when the option is chosen.

- Less than 50 employees.

- Annual sales or balance sheet of less than €10 million.

- 50% of voting rights held by individuals.

- 34% of voting rights held by the Chairman, Chief Executive Officer, Chairman of the Supervisory Board or Managing Director.

The option to be subject to corporate income tax is valid for five financial years. Renewal is not possible.

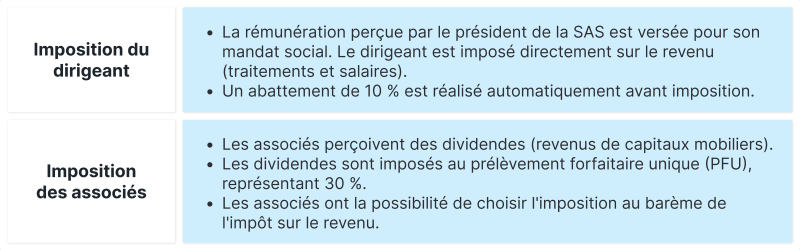

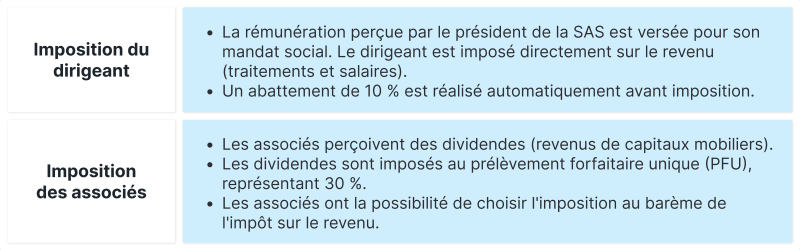

Taxation of SAS managers and partners

Taxation of SAS directors and partners deserves detailed analysis:

Social security for SAS managers

The Chairman of an SAS is treated as an employee. He therefore benefits de facto from the social protection offered by the general Social Security system. The SAS pays social security contributions directly to the social security organizations. These contributions are identical to those of an executive employee.

However, the Chairman of an SAS does not contribute to unemployment insurance. To build up this safety net, he must take out supplementary unemployment insurance.

The social benefits available to SAS directors are as follows:

- family allowances ;

- health and maternity insurance ;

- accidents at work ;

- pension insurance ;

- provident insurance.

Note: dividends received by SAS directors are not considered as remuneration. They are income from movable capital. They are therefore not subject to social security contributions.

How do I set up an SAS?

The steps involved in creating an SAS are fairly similar to those for other legal forms (SARL, EURL, SASU).

The main steps in setting up an SAS

The steps are as follows:

Is a shareholders' agreement mandatory when creating an SAS?

The creation of a simplified joint-stock company requires the drafting of articles of association. These include the essential information about the SAS. It is not necessary to draw up a shareholders' agreement if you wish to create an SAS. The Articles of Association already have this function.

However, it is considered strategic to draw one up. The purpose of an associates' agreement is to preserve relations between associates on the following points :

- conditions of sale of shares ;

- the right to information ;

- non-competition obligation ;

- dividend distribution, etc.

Entrepreneurs wishing to set up an SAS can call on the advice of lawyers, notaries or chartered accountants for comprehensive support.

How much does it cost to set up an SAS?

Creating a simplified joint stock company involves costs. SeDomicilier explores the different categories with you.

Administrative set-up costs

Setting up an SAS costs next to nothing: you will need to pay the statutory fees to the Registry of the Commercial Court court. These fees vary from region to region, and run into the hundreds of euros.

Setting up your own SAS involves fulfilling the obligatory legal formalities. Entrepreneurs wishing to carry out the formalities themselves pay the organizations directly. It is also possible to use the services of a professional, such as a lawyer. Additional fees apply for these services. There are two types of costs involved in launching an SAS:

- emoluments of the clerk of the commercial court ;

- legal advertising expenses.

The clerk's fee is linked to the registration process. It also includes the service of declaring the beneficial owners of the SAS:

- SAS registration: 35.59 euros

- Declaration of beneficial owners: approx. 20.64 euros

Publication of an advertisement in a legal gazette (JAL) costs 236.40 euros (incl. VAT) in mainland France. For Reunion and Mayotte, the cost is 250.64 euros.

To remember : In 2025, the administrative costs of setting up an SAS in mainland France will amount to 292.33 euros.

Support costs for setting up an SAS

Support solutions are available for entrepreneurs wishing to launch an SAS business. Depending on your needs, these may include :

- drafting the articles of association ;

- drawing up and distributing the notice of incorporation in a JAL ;

- Enter the M0 creation form;

- filing with the Clerk of the Commercial Court.

You can outsource the process of setting up an SAS to a lawyer, a legal department or a chartered accountant. Depending on the service provider, costs range from €1,500 to €2,500.

Get help from a domiciliation expert

The president of the SAS can call on the services of a company domiciliation company to help with the formalities involved in setting up the company. SeDomicilier assists SAS creators with the formalities involved in setting up their company, thanks to a dedicated package: drafting the SAS articles of association and the announcement for the JAL, compiling the file for the clerk's office, domiciliation of the SAS, etc.

Other costs to consider when setting up your SAS are the purchase of fixed assets and equipment, rental of premises, etc. These vary according to the characteristics of your project. They vary according to the characteristics of your project.

How long does it take to set up an SAS?

To create your SAS, you need to file an application with the Registrar of the Commercial Court. A SIRET number will be issued within 3-4 weeks. With this number, your company is legally recognized. You can then start trading.

You need to take into account the time required to draw up the articles of association, deposit the share capital with your bank, fill in the CERFA M0 form and publish the legal announcement of the company's creation.

Why set up an SAS?

SAS companies offer two key advantages: flexibility and simplicity. This legal form appeals to the vast majority of French entrepreneurs:

This dynamism is due to the simplicity of the formalities involved in creating, managing and dissolving an SAS. It is headed by a chairman with either legal or corporate personality. To create an SAS, a minimum share capital of €1 is required. Two partners are all you need to launch your SAS. This form offers entrepreneurs a solid internal organization combined with a simplified mode of governance.

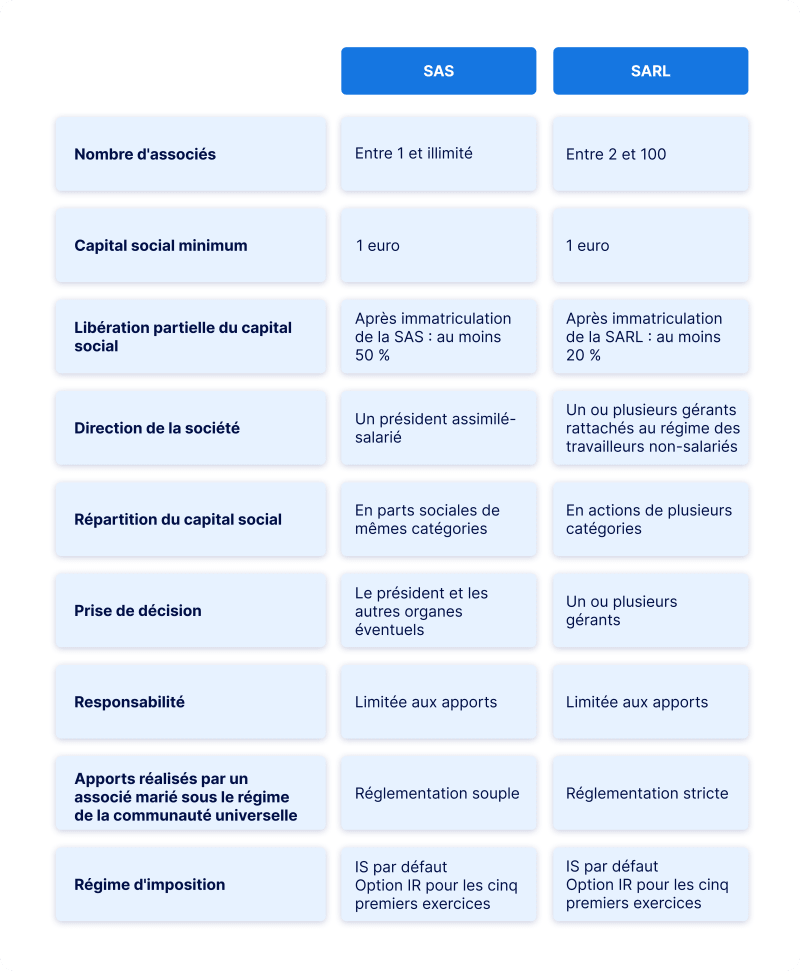

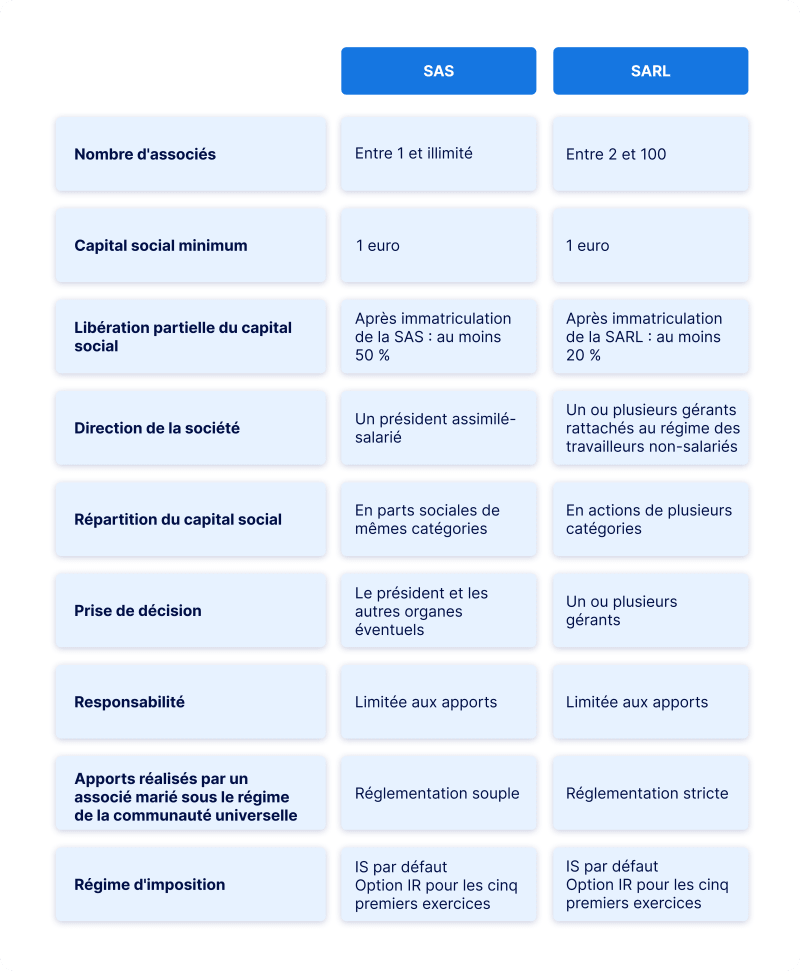

Still undecided between SAS and SARL? SeDomicilier offers you a comparison table:

From a tax point of view, SARLs and SASs are subject to the same requirements, with the exception of family SARLs. Under certain conditions, these can be taxed under income tax rather than corporation tax.

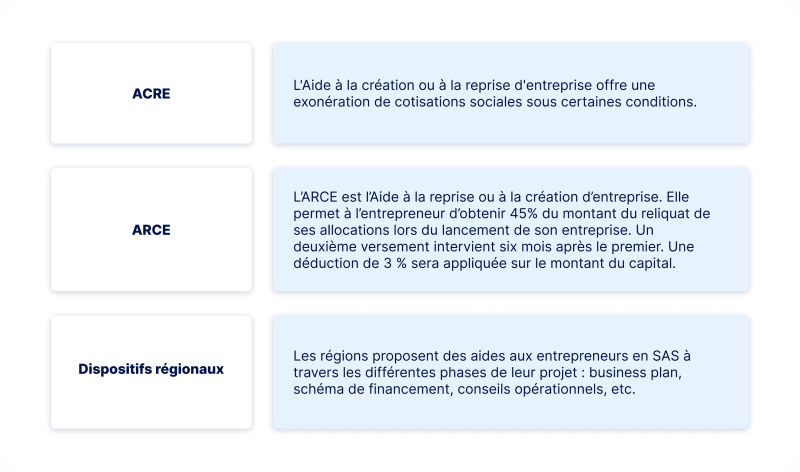

How can you set up your SAS?

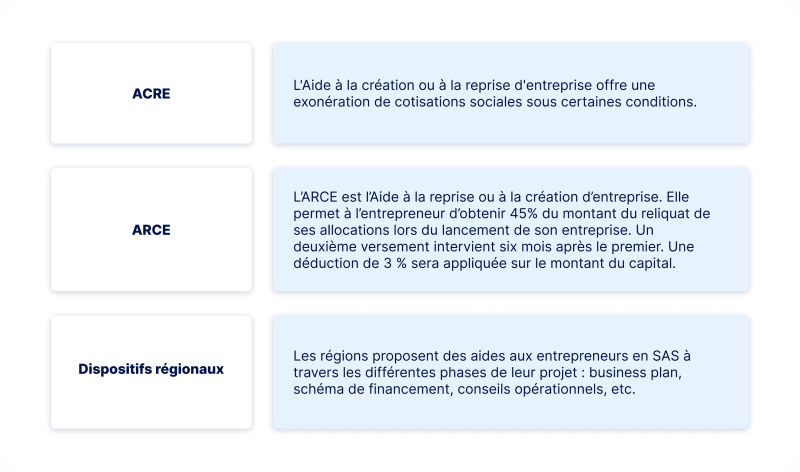

A number of government grants are available to SAS founders:

The SAS is a flexible legal form for entrepreneurs wishing to launch their business. It also has a single-person version, the SASU. SeDomicilier can help you set up and manage your SAS through a range of tailor-made services.

Menu / Adresses

Menu / Adresses Menu / Fiches pratiques

Menu / Fiches pratiques Menu / Services

Menu / Services

Menu / Adresses

Menu / Adresses Menu / Fiches pratiques

Menu / Fiches pratiques Menu / Services

Menu / Services