On February 3, 2025, the government used Article 49.3 to pass the PLF 2025 without a vote. Among the text's provisions was an amendment to article 293B of the French General Tax Code, introducing a single threshold of 25,000 euros for basic VAT exemption.

This threshold was due to come into force on March 1, 2025.

Until now, micro-businesses have benefited from different thresholds depending on their activity:

-

37,500 euros for services and liberal professions,

-

85,000 for merchandise sales and accommodation activities.

With the reform, these thresholds would have been replaced by a single threshold of €25,000, and an increased threshold of €27,500.

Thus :

-

Below €25,000 in annual sales, the VAT exemption would have continued to apply.

-

Between €25,000 and €27,500, VAT liability would have been effective from January 1 of the following year.

Over 27,500 euros, VAT would have been charged from the day the amount was exceeded.

This measure concerned more than 200,000 micro-entrepreneurs and would have generated 700 million euros for the State in 2025, according to estimates by the Ministry of the Economy.

As soon as the lower threshold was announced, many organizations representing the self-employed, such as the Fédération nationale des auto-entrepreneurs (FNAE) and the Association pour le droit à l'initiative économique (Adie), voiced their opposition.

Several criticisms have been made:

-

A heavier administrative burden: micro-entrepreneurs would have had to manage VAT collection, declaration and repayment, making their business more complex.

-

A loss of competitiveness: the need to charge VAT could have made their services 20% more expensive, putting them at a competitive disadvantage vis-à-vis better-structured companies already subject to VAT.

-

A risk of concealed work: some self-employed people might have been tempted not to declare all their sales to avoid exceeding the threshold. A negative impact on small businesses: particularly for professionals at the start of their career or with a complementary activity.

The Union nationale des professions libérales (UNAPL) denounced the "brutal" decision, calling for a moratorium and an emergency meeting with Bercy. The organization highlighted the difficulty many liberal professionals will have in coping with this reform, particularly those with partial or start-up activities.

On the other hand, some employers' organizations supported the measure, believing that it would enable a return to a competitive balance between micro-entrepreneurs and very small businesses (VSEs) already subject to VAT.

Political opposition and a possible government retreat

Faced with the pressure, several elected representatives are considering legal action against the reform. Hadrien Clouet, MP for La France Insoumise (LFI), was planning to table a bill to overturn the measure. LFI was also planning to table a motion of censure, although the Rassemblement National (RN) and the Parti Socialiste (PS) have announced that they will not join in.

The government also faced reservations within Parliament itself. On February 6, 2025, the Minister of the Economy, Éric Lombard, finally announced the suspension of the lowering of the VAT threshold. He specified that this suspension would last "the time for consultation", in order to "adjust the measure if necessary".

MP Éric Coquerel, LFI chairman of the National Assembly's Finance Committee, said the measure could be corrected in the coming months through a new bill. He also pointed out that opposition to the reform cuts across party lines, with some elected representatives from a variety of backgrounds expressing doubts about its effectiveness and impact on small businesses.

Although the lowering of the threshold has been suspended, it has not been totally abandoned. The government could propose an adjustment to the measure after consulting the stakeholders concerned. The Senate could also play a role in the discussions.

If the reform were to be reintroduced in amended form, it could include transitional measures or assistance to help micro-entrepreneurs adapt to VAT.

The main challenge will be to strike a balance between the government's objective of tax simplification and harmonization, and the concerns of small entrepreneurs who fear negative effects on their business.

Alternatives to micro-business

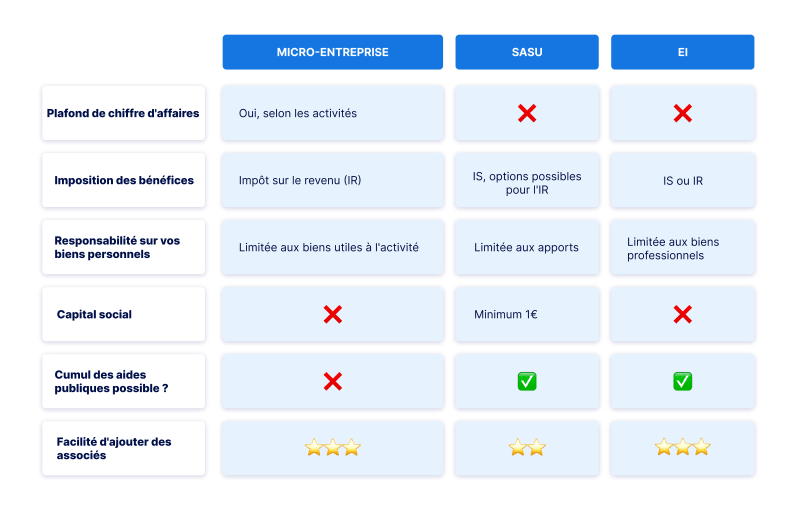

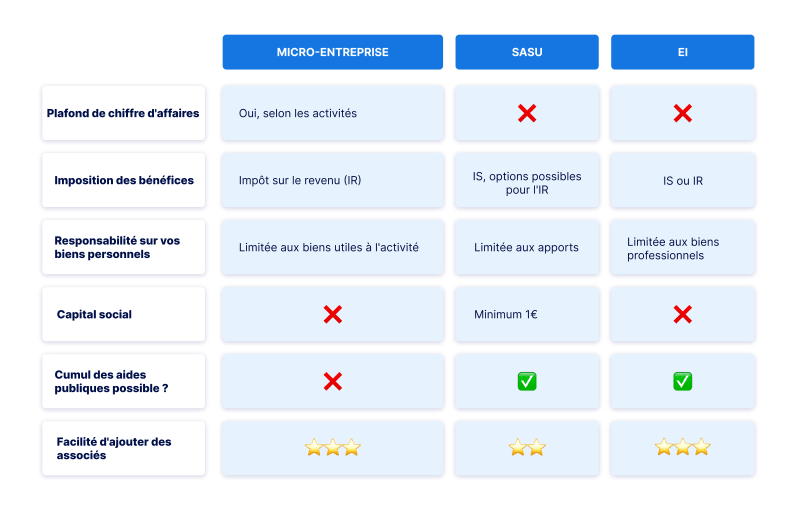

Although the micro-enterprise is an attractive option for starting up a business, thanks to its administrative and tax simplicity, other statuses may be more suitable, depending on the needs and nature of the entrepreneurial project. These alternatives include the Entreprise Individuelle (EI) and the SASU(Société par Actions Simplifiée Unipersonnelle).

Conclusion

The introduction of a single VAT threshold of €25,000 was intended to simplify the tax system and bring France into line with European practice. However, this reform would have had major consequences for many self-employed people, calling into question one of the key advantages of the micro-enterprise status.

The suspension of the measure reflects a recognition of the difficulties raised by professionals and the political tensions surrounding the issue. The consultation process announced by the government will be decisive for the future of this reform and the tax regime for micro-entrepreneurs in France.

Written by our expert Evan

February 7, 2025