Becoming self-employed: why choose freelance administration?

A new form of employment, halfway between self-employment and salaried employment, "portage salarial" enables you to develop an independent professional activity while retaining the social security cover enjoyed by salaried employees. Here's a closer look at four of the main advantages of this new form of employment.

What is "portage salarial"?

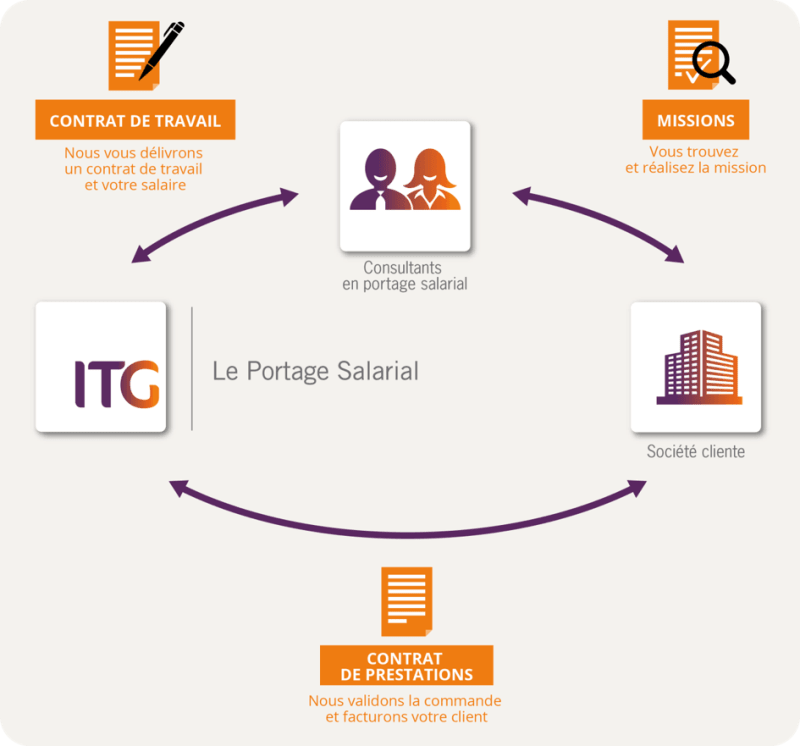

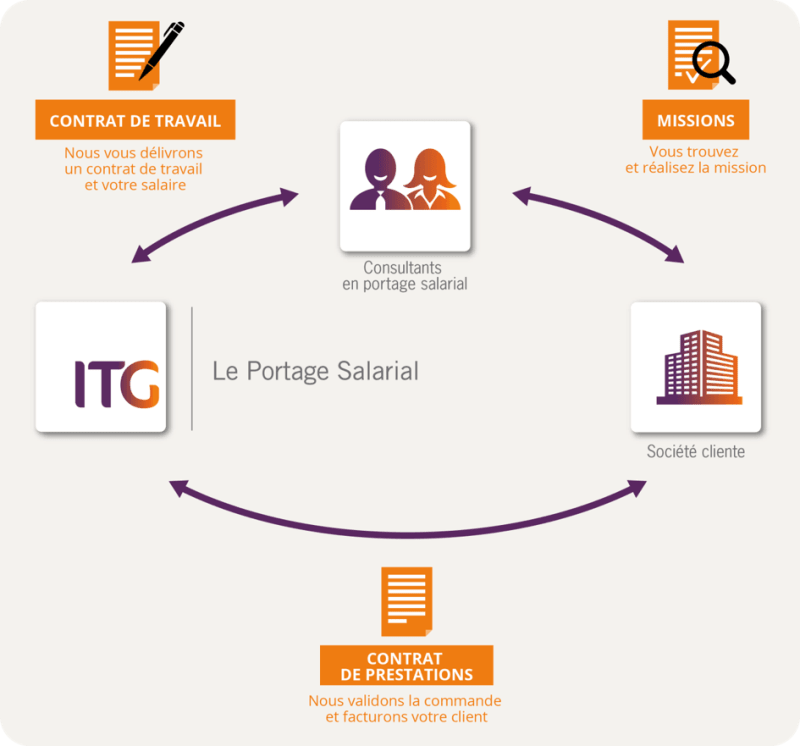

The legislator has designated "portage salarial" as the organized grouping of :

"On the one hand, the relationship between a company called "entreprise de portage salarial" providing a service for the benefit of a client company, which gives rise to the conclusion of a commercial contract for the provision of a portage salarial service.

"2° On the other hand, the employment contract concluded between the freelance administration company and an employee designated as the "freelance employee", who is remunerated by this company.

There are 3 parties involved in freelance administration:

The "salarié porté", also known as a consultant, who finds and carries out assignments for client companies.

The "portage salarial" company, which carries out the activity of the "porté" employee and invoices the client company.

The client company, which calls on the services of the ported employee

ITG offers you a diagram summarizing how freelance administration works:

Being self-employed with employee status: a considerable advantage

This is the first major advantage of freelance administration. The individual carries out his or her activity in total autonomy. They benefit from both the security of salaried employment and the various advantages inherent in this status: unemployment insurance if they stop working, contributions to the general pension scheme, coverage in the event of illness through a supplementary company health insurance scheme to cover health expenses, civil liability insurance, provident insurance to cover potential risks linked to business travel, and CESU pre-funded vouchers to benefit from tax advantages.

What's more, the first payment is made in the first month following registration on the freelance administration scheme, i.e. the first month worked, since services are invoiced in the form of fees. They are then paid to the freelance consultant in the form of a salary.

When a consultant or freelancer joins a freelance administration company, he or she also has access to the training program offered by the freelance administration company he or she has chosen. In most cases, the content of these training courses is designed to help freelance consultants develop their business from a commercial point of view, successfully complete all their assignments, or obtain all the keys they need to sustain their business over the long term. These training courses enable freelance consultants to benefit from real support and to be in the best conditions to boost their business.

Genuine self-employed status

As a freelance consultant, you enjoy total autonomy. They choose the assignments they wish to carry out themselves. Based on his or her expertise, the consultant determines how the assignment is to be carried out. What's more, consultants are in direct contact with their customers, and negotiate their fees directly with them. He sets his own rates, based on his level of expertise, skills and experience in his field. His rates may also depend on the rarity of his specialization. Finally, he determines his own working hours and environment.

Administrative procedures managed by the freelance administration company

By deciding to become self-employed using the "portage salarial" system, a freelancer simplifies administrative formalities, since these are handled by his or her employer: the "portage salarial" company. The company takes charge of invoicing and declaring all charges relating to the freelancer's activity. The freelancer can therefore devote all his or her time to work and business development, without wasting time and energy on paperwork.

In addition, the consultant himself declares his professional expenses and hours worked.

Finally, as freelance administration does not require the creation of a legal structure, self-employment begins as soon as the very first assignment is signed.

Would you like to find out more about freelance administration and get a comprehensive overview of this fast-growing new form of employment? We invite you to consult our guide to freelance administration.

Written by our expert Editorial staff

October 6, 2017