Operating income calculation: what is it?

The operating result accounts for all current operations over an accounting period.

A definition of operating profit or operating income.

The operating income, or operating profit, is a performance indicator for your company. It's basically the total of your operating revenues minus your operating expenses.

The operating result provides an assessment of the economic model of your business. This indicator assesses your company's ability to generate results based on production or economic assets held. In contrast to the operating result, the gross operating surplus is an indicator for measuring factors that improve the operating result.

How to calculate operating income?

The easiest way to calculate the operating result is to check the income statement. You need to subtract operating expenses from all revenues. So, the formula is:

-

Operating income = operating revenue - operating expenses

How to interpret the operating result?

After calculating the operating result, two interpretations can be made:

- The amount of income exceeds expenses: the company is profitable.

- The amount of expenses is greater than the operating income: the company is losing money.

If the amount in the operating income statement is close to zero, it could be due to a problem related to high raw material costs, excessive wage costs, an overly competitive market, etc.

How to go from operating income to gross operating surplus (EBE)?

EBE is the gross operating surplus. It is calculated before the operating result. The EBE is calculated using the following formula:

EBITDA = Revenue - (Purchased consumables + Consumption from third parties + Personnel expenses + Operating subsidies + Taxes).

With the gross operating surplus, it is possible to calculate the operating result by adding reversals of operating expenses, transfers of operating expenses, etc. The GOS includes a subtraction of depreciation, provisions and the removal of management expenses.

What goes into calculating operating income?

The operating income is made up of several items. SeDomicilier breaks down these elements for you, point by point.

Turnover

Turnover includes sales of goods and services. This indicator appears excluding taxes (HT) and not in the form all taxes included (TTC). The sum collected by the company is TTC. It includes the VAT to be collected and then paid to the Public Treasury. Therefore, it is not relevant to include VAT in the calculation of the operating result.

Operating grants

An operating subsidy is a solution to finance the operating expenses of a company. Are you wondering what the operating expenses are? These may include expenses relating to energy, telephone-Internet, personal expenses, purchases of raw materials, etc.

Getting an operating subsidy can be specifically for funding the purchase of equipment to boost the company's performance, like IT equipment, production machines, etc.

Obtaining an operating subsidy is an interesting lever to finance a lack or insufficiency of operating income. It is directly added to the company's profit for the year in question.

The purchase of raw materials or goods

The purchase of raw materials or goods impacts a company's operating profit. Purchase costs reduce your profit margin. This is especially important for trading companies.

Stored production

Inventories of finished goods represents the change in inventories and work-in-progress of goods/services between the beginning and end of a financial year. Production is valued on the basis of the cost of producing the products.

Operating expense transfers

The item for transfer of expenses may include government aid for employment contracts: single integration contract, support for apprenticeship, etc. It is possible to benefit from a transfer of expenses to offset the costs incurred by renovation work following a disaster.

Other operating expenses

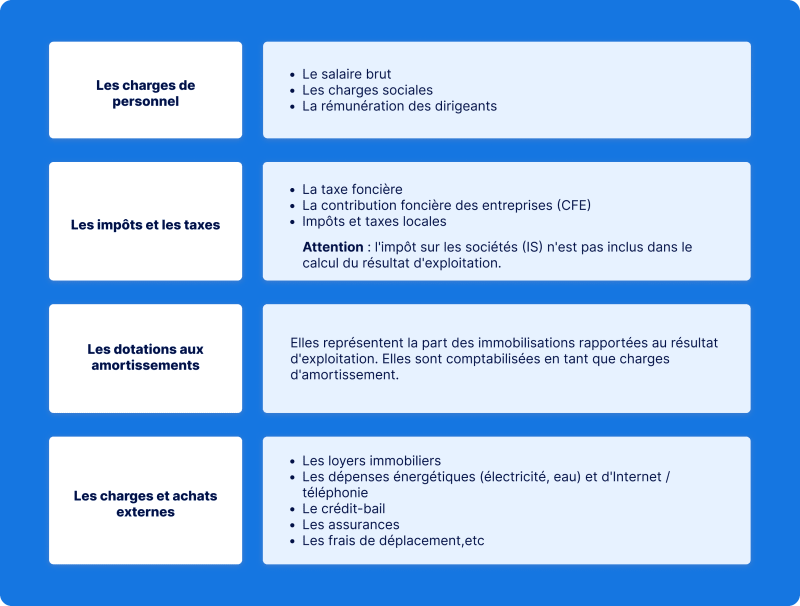

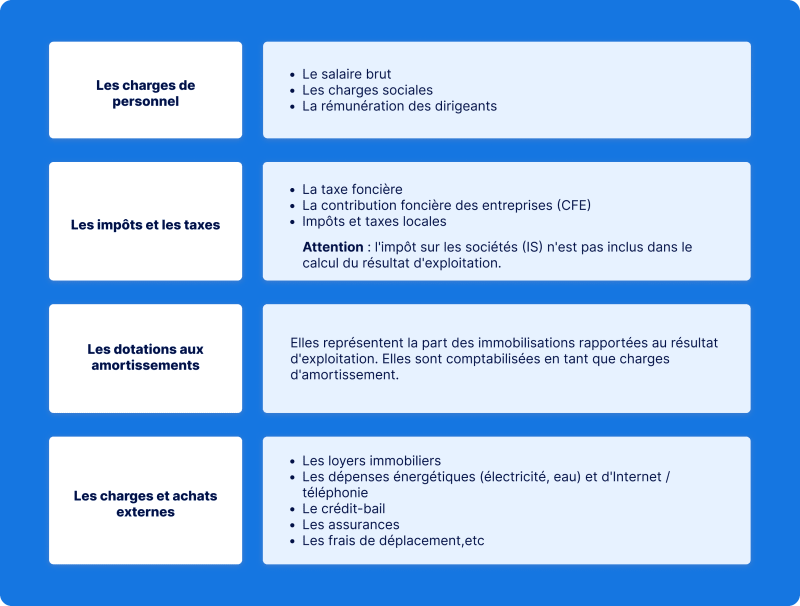

The operating income statement includes other expenses. Here is a summary table:

A summary of operating income and expenses.

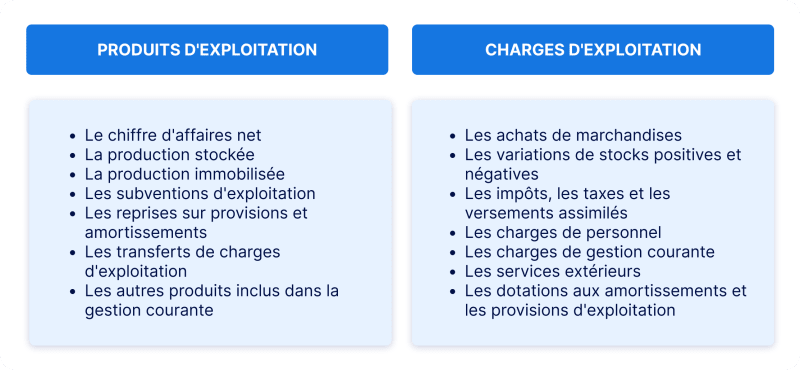

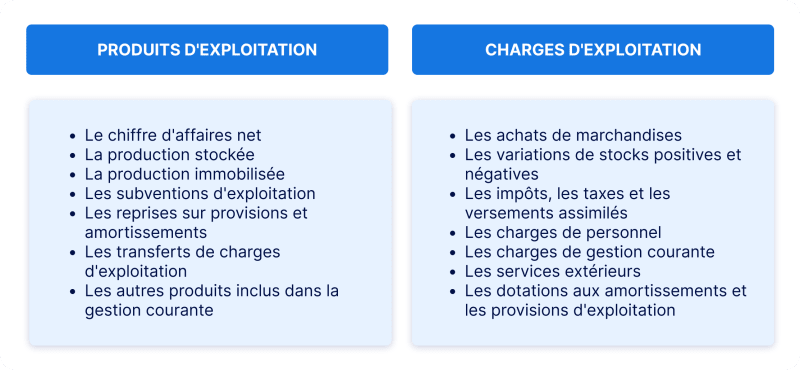

SeDomicilier provides a summary of operating expenses and income:

Maybe you're wondering about the differences between income and expenses? Let's clear that up for you:

- The products are equivalent to your company's revenue.

- Expenses are basically what your company loses money on.

The operating result is obtained by subtracting the total of your operating expenses from the total of your operating income.

Measuring your company's performance is important. It is essential for developing your growth strategy.

Why measure your company's performance?

This process requires you to produce quantified results in the form of financial, quantitative, and sometimes qualitative ratios. Measuring performance helps you better understand your results. It allows you to interpret your growth and improvement factors.

What other barometers should be taken into account?

The following indicators can be used to measure a company's health:

The operating result is a key performance indicator gauging the financial health of your company. A detailed analysis of the operating result makes it possible to detect the levers to be developed to optimise your business's income.

Written by our expert Evan

February 4, 2025