What is the minimum capital of an SAS?

The creation of a simplified joint-stock company (SAS or SASU in the case of a single shareholder) requires a minimum share capital. This share capital constitutes the resources allocated to the SAS at the time of its creation and throughout its life.

Determining the amount of a public limited company's share capital

The minimum share capital of a company varies according to its legal form. For SAS, the minimum share capital is set at a symbolic €1.

In other words, you can set up an SAS with very little capital outlay, unlike a société anonyme (SA), which requires a minimum share capital of €37,000.

The amount of share capital is freely determined by the partners. It may be constituted by contributions in cash (a sum of money) or in kind (property other than money). It is even possible to make industrial contributions (skills or know-how).

You should also be aware that the amount of share capital may change during the life of the company. In fact, it is not uncommon for the partners to decide to increase or decrease the share capital of an SAS.

Releasing the share capital of a SAS

When an SAS is created, half of the share capital must be paid up, i.e. paid into a blocked account available to the company. The other half of the share capital must be paid up within 5 years of the company's registration.

But how do you deposit the share capital of an SAS? Simply deposit the funds in a blocked account at a bank or notary's office.

Please note, however, that contributions in kind must be fully paid up when the company is created.

All this information must be set out in the SAS Articles of Association.

What is the point of having a minimum share capital for SAS?

There are many advantages to having a minimum share capital in an SAS:

- Distribution of shares among associates ;

- Obtaining external financing;

- Credibility with third parties (creditors and investors).

Distribution of shares among associates

To become a partner in an SAS, you need to make a contribution to the company's share capital. The share capital is used to distribute the company's shares among the partners.

Each partner makes a contribution, the amount of which varies according to his or her resources.

In this way, each partner holds shares in proportion to his or her contribution to the share capital.

This means that associates can obtain voting rights according to the contributions they have made. The amount of share capital is therefore a decisive factor, as it is used to distribute the partners' powers within the company.

Obtaining external financing

Share capital also helps finance the company's initial investments. It is therefore very useful when launching your business, although you can always choose other means of financing.

A high level of share capital provides greater security for the partners, as it forms a solid basis for financing the start-up of your business. It offsets the company's debts, reducing the risk of stress in the event of cash flow difficulties.

So, even if you can set up an SAS with a share capital of 1 euro, it's still advisable to bring in sufficient funds. A low level of share capital could complicate access to external financing, such as bank loans or venture capital investments.

Third-party credibility

A high level of SAS share capital also reflects the company's financial strength. Indeed, the initial capital is a relevant indicator of the company's health, and demonstrates thepartners' commitment to the company's development.

This is a real guarantee of credibility for third parties (creditors and investors). Investors will be more inclined to invest in a company with a strong capital base, as they will find it easier to be reimbursed in the event of debts.

It is not uncommon for the share capital to change during the life of a company. The partners may decide toincrease the share capital for various reasons:

- integrate new associates ;

- meet a financing need ;

- strengthen their credibility with third parties (customers, suppliers, investors, etc.).

The increase in share capital can take two different forms:

- the issue of new shares ;

- an increase in the par value of the shares.

To increase the share capital of an SAS, you need to follow a number of strict steps:

-

step 1: make a collective decision at the general meeting ;

-

step 2: publish a legal notice ;

-

step 3: declare the modification on the Guichet unique website.

Stage 1: Collective decision by shareholders at a general meeting

To increase the share capital of an SAS, a collective decision by the partners is required. This decision must be taken at a shareholders' meeting. To do this, you need to refer to the majority conditions set out in the Articles of Association. These vary according to the type of contribution (cash or in-kind).

At the Annual General Meeting, associates can vote to modify the company's share capital. This decision must be taken by a majority of associates present or represented, in accordance with the quorum and majority rules set out in the company's bylaws.

The decision is then recorded in the minutes.

However, in the event of anincrease in the par value of the shares, theunanimous agreement of the shareholders is required.

It should also be noted that the funds arising from the payment of the shares must be deposited with the notary or bank within 8 days of receipt. This deposit is validated by a certificate from the depositary.

In the case of a contribution in kind, 2 copies of the appraisal report must be filed with the commercial court clerk's office at least 8 days before the date of the Annual General Meeting.

Step 2: Publication of the legal notice

Once the shareholders have decided to modify the share capital of an SAS, the legal representative (usually the Chairman of the SAS) must publish the change in a legal gazette. This publication serves to inform third parties of the change.

The legal notice must include the following mandatory information :

- Company name and acronym, if any;

- the legal form of the company: société par actions simplifiée (SAS) ;

- the amount of the former share capital, before the planned capital increase ;

- the address of the company's registered office ;

- the Siren number and the words "RCS", followed by the name of the town where the company is registered;

- the nature of the change in capital (in cash, in kind or by incorporation of reserves);

- the form chosen to increase the share capital: issue of new shares or increase in the par value of existing shares;

- the new number of shares and their total value in euros ;

- the amount of the new share capital ;

- the management body that decided to increase the share capital;

- the date of the shareholders' decision, and its effective date, if any.

In addition, the legal announcement must be published within 1 month of the decision being taken.

In return, the SAS receives a certificate of publication in a legal gazette. This document must be kept in a safe place for the declaration of modification.

Step 3: Declaration of the modification on the one-stop shop website

To finalize the increase in share capital, the modification must be declared on the Guichet unique de formalités des entreprises website.

At the time of declaration, you must provide the following supporting documents:

- a copy of the minutes recording the capital increase;

- a copy of the updated bylaws ;

- a certificate of publication of the modification notice in a legal announcements medium;

- a certificate of deposit of funds (in the case of a cash contribution) ;

- a receipt for the auditor's valuation report, in the case of a contribution in kind.

In addition, if the increase in share capital leads to a change in the beneficial owners, this change must also be declared on the Guichet unique website.

Finally, in the case of a capital increase through contributions in kind, registration with the tax authorities (SIE) is required. Conversely, in the case of contributions in cash or by incorporation of reserves, no registration formalities are required.

The document recording the capital increase (often the minutes of the shareholders' meeting) must be filed in person or sent by post within 1 month of the date on which the increase is recorded. This procedure is free of charge.

What types of contribution are possible in SAS?

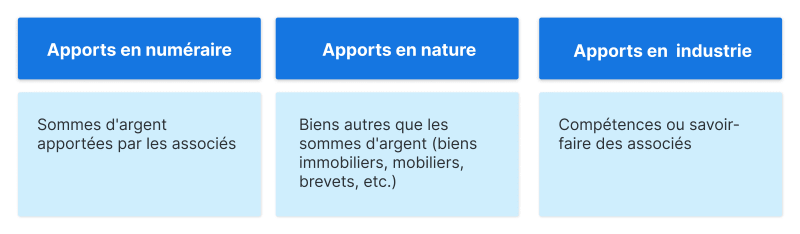

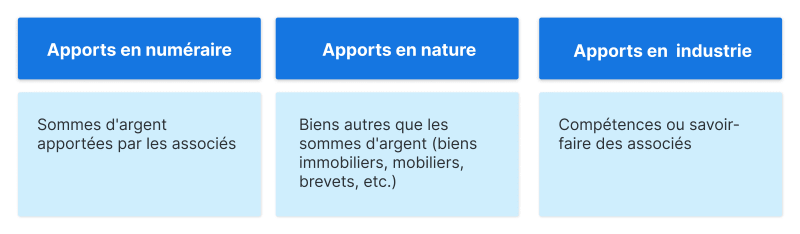

The share capital is made up of various contributions made by the partners when the company was created:

- cash contributions ;

- contributions in kind ;

- contributions in kind.

Cash contributions

Cash contributions are sums of money contributed by associates. They make up the share capital.

Each partner can contribute whatever funds he or she wishes. Depending on the amount contributed, they will have more or less power within the SAS.

Contributions in kind

In SAS, contributions in kind consist of assets other than money. These may include real estate, movable assets (cars, equipment), patents, software, etc. These in-kind contributions are included in the share capital. These in-kind contributions are included in the share capital.

But how do you determine their value? To determine the value of an asset, it must be appraised. Some assets are easy to estimate, others less so (e.g. patents).

In a simplified joint-stock company (SAS), it is compulsory to appoint a contribution auditor to evaluate the assets contributed by the partners to the company. The fees for a commissaire aux apports can be very high (up to €3,000). However, this rule can be waived if two conditions are met:

- none of the contributions in kind has a value in excess of €30,000;

- the total value of contributions in kind does not represent more than half of the share capital.

Thus, if these two conditions are met, the partners may decide not to appoint a contribution auditor.

Industrial contributions

Unlike other contributions, industrial contributions are not included in the share capital. This means that associates have no rights or shares in the company.

Industrial contributions represent the skills or know-how that associates bring to the company. It is very difficult to evaluate an industrial contribution, which is why it cannot be included in the share capital.